FIDEUM: Difference between revisions

No edit summary |

No edit summary |

||

| Line 4: | Line 4: | ||

'''Brief description:''' | '''Brief description:'''<br> | ||

Incomplete markets require new statistical, analytical, and numerical methods, to cope with stochastic volatilities or jumps in the stochastic processes, e.g. These are investigated in a joint project of Universität Heidelberg (with focus on modeling, analysis and statistics), Universität Bonn (with focus on numerics) and SCCS (with focus on software development). The goal of our work in the project is to integrate newly developed methods - especially sparse grid techniques - into the framework of ThetaML, a system of [http://www.thetaris.com/22-0-Imprint.html Thetaris GmbH] that allows rapid formulation and analysis of complex financial derivatives. | Incomplete markets require new statistical, analytical, and numerical methods, to cope with stochastic volatilities or jumps in the stochastic processes, e.g. These are investigated in a joint project of Universität Heidelberg (with focus on modeling, analysis and statistics), Universität Bonn (with focus on numerics) and SCCS (with focus on software development). The goal of our work in the project is to integrate newly developed methods - especially sparse grid techniques - into the framework of ThetaML, a system of [http://www.thetaris.com/22-0-Imprint.html Thetaris GmbH] that allows rapid formulation and analysis of complex financial derivatives. | ||

Revision as of 12:55, 2 February 2009

Finanzderivate in unvollständigen Märkten

(Modeling and Valuation of Financial Derivatives in Incomplete Markets)

financed by the BMBF support program: Mathematics for innovations in the Industrial and Service Sectors

Brief description:

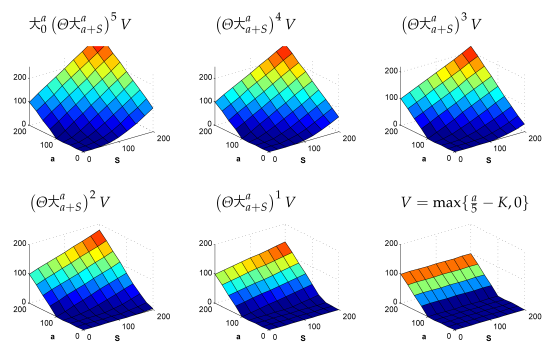

Incomplete markets require new statistical, analytical, and numerical methods, to cope with stochastic volatilities or jumps in the stochastic processes, e.g. These are investigated in a joint project of Universität Heidelberg (with focus on modeling, analysis and statistics), Universität Bonn (with focus on numerics) and SCCS (with focus on software development). The goal of our work in the project is to integrate newly developed methods - especially sparse grid techniques - into the framework of ThetaML, a system of Thetaris GmbH that allows rapid formulation and analysis of complex financial derivatives.

Figure 1: A financial product - here an American option - can be visualized as "Thetagram" or modeled as text as a so-called "ThetaScript".

Figure 2: Generating a simulation from the model: Here, the development of an Asian option is illustrated.

Co-operation partners:

- Prof. Dr. Drs. h.c. Willi Jäger (IWR, University of Heidelberg)

- Prof. Dr. Markus Reiß (Institute of Applied Mathematics, University of Heidelberg)

- Prof. Dr. Michael Griebel (Institute for Numerical Simulation, University of Bonn)

Contact:

Stefanie Schraufstetter, Stefan Zimmer